Understanding accumulated depreciation is an important part of accounting. This may seem like a complicated topic, but it is easy to grasp and can help you understand the life-cycle an asset. You will be unable to convert cash into it for at least one year after you have purchased a fixed asset like a building or machine. These assets are used to produce income and include machinery, real estate, furniture and office equipment.

Contra-asset accounts can be credited for accumulated depreciation

The contra-asset is a way to track depreciation expenses for tools, equipment, and other company resources. It is usually paired with the current assets account on a company's balance sheet. This account will help you to understand the effect of depreciation and how it affects your company's net profit.

Accumulated Depreciation is a record that tracks the decline in value over time. These assets could include machinery, offices equipment, vehicles and company buildings. These assets cannot be immediately disposed of, rather they are used to lower the value of others assets.

It reduces t account depreciation

Reduces-t account depreciation refers to a tax accounting method that uses a percentage the original cost of a fixed property to lower its cost. This can be used to depreciate a property that is rapidly losing its value. Depreciation can also be used to gain a better understanding of the financial position of a company. This helps to ensure that the income statement and balance sheet are accurate.

It is a non-cash expense for a business.

Business is characterized by amortization and depreciation as non-cash expenses. Both are applicable to long-term assets. Both refer to long-term assets. Depreciation is the cost of purchasing physical assets. Amortization refers to the cost of buying intangible assets. In this example, a company would pay $10,000 in patent payments over 20 years. The cost of a patent is amortized over those twenty years, allowing a business to spread the cost over many years without paying in cash immediately.

Depreciation is a non-cash expense that's reported on the income statements but does not receive a cash payout. One example is if a company buys equipment for $200,000 2 years ago. For 10 years, the company will have to depreciate $20,000 annually. In the current year, the company will have an expense of $20,000, but no cash payment. Depreciation is a non-cash expense.

It lowers the cost for a longer-lasting asset

Depreciation can be used to reduce the cost of assets over a longer time. An asset's cost is evenly distributed over its useful life by a predetermined schedule. Companies use depreciation tables to determine the asset's cost.

Depreciation reduces the cost of long-lived assets by tying the cost of use to the economic benefit over the asset's useful life. There are many types of depreciation, such as straight-line and accelerated. One company might have higher depreciation expenses in the initial years of an asset's life but may defer taxes on those early years.

FAQ

How do accountants work?

Accountants work together with clients to maximize their money.

They also work closely with professional such as attorneys, bankers or auditors.

They also support internal departments such marketing and sales.

Accountants are responsible in ensuring that books are balanced.

They determine the tax amount that must be paid to collect it.

They also prepare financial statement that shows how the company is performing.

What is Certified Public Accountant?

A certified public accountant (C.P.A.) A person who is certified in public accounting (C.P.A.) has specialized knowledge in the field of accounting. He/she is able to prepare tax returns and help businesses make sound business decisions.

He/She also monitors the cash flow of the company and ensures that it runs smoothly.

What is accounting's purpose?

Accounting provides an overview of financial performance by measuring, recording, analyzing, and reporting transactions between parties. It allows organizations to make informed financial decisions, such as whether to invest more money, how much income they will earn, and whether to raise additional capital.

To provide information on financial activities, accountants record transactions.

The company can then plan its future business strategy, and budget using the data it collects.

It is essential that data be accurate and reliable.

Statistics

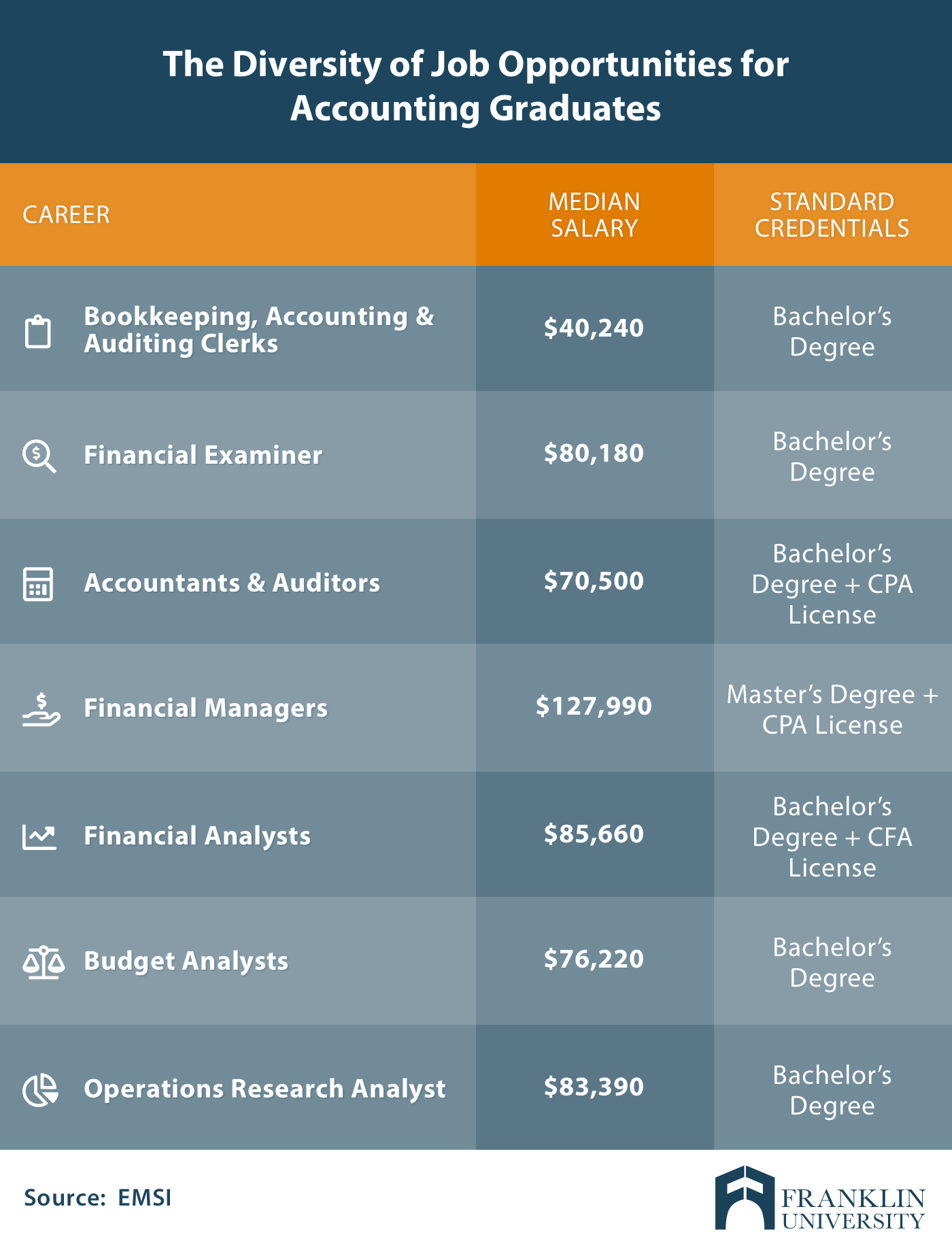

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

How to bookkeeping

There are many types of accounting software available today. While some software is free and some cost money to purchase, many offer basic functions such as billing, invoicing, inventory management, payroll, point-of sale, financial reporting, and processing of payroll. The following list provides a brief description of some of the most common types of accounting packages.

Free Accounting Software: Free accounting software is usually offered for personal use only. While it might not be as functional as you would like (e.g. you cannot create reports), the software is usually very simple to use. Many free programs also allow you to download data directly into spreadsheets, making them useful if you want to analyze your business's numbers yourself.

Paid Accounting Software: These accounts are for businesses that have multiple employees. These accounts provide powerful tools for managing employee records and tracking sales and expenses. They also allow you to generate reports and automate processes. Although most paid programs require a minimum of one year to subscribe, there are many companies that offer subscriptions for as little as six months.

Cloud Accounting Software: With cloud accounting software, you can access your files online from any device using smartphones or tablets. This type of program has become increasingly popular because it saves you space on your computer hard drive, reduces clutter, and makes working remotely much easier. It doesn't require you to install additional software. You just need an Internet connection and a device capable to access cloud storage.

Desktop Accounting Software: Desktop software works in a similar way to cloud accounting software. However, it runs locally on your own computer. Desktop software allows you to access your files anywhere, even via mobile devices, just like cloud software. You will need to install the software on your PC before you can use it, however, unlike cloud software.

Mobile Accounting Software: Our mobile accounting software can be used on smartphones and tablets. These programs make it easy to manage your finances wherever you are. Typically, they provide fewer functions than full-fledged desktop programs, but they're still valuable for people who spend a lot of time traveling or running errands.

Online Accounting Software: This online accounting software is intended primarily for small business. It offers all the functionality of a desktop program, plus some extra features. One advantage of online software is that it requires no installation; simply log onto the site and start using the program. Another benefit is that you'll save money by avoiding the costs associated with a local office.