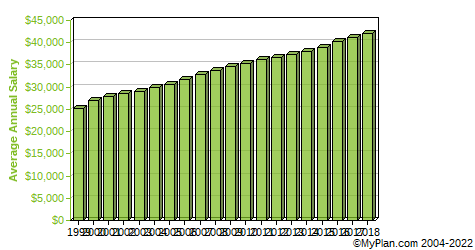

The Average Bookkeeping salary is $48,000 per year. While the average salary for Bookkeepers is higher than those who work as managers or senior Bookkeepers it is $30,000 per annum. The top paying sectors for Bookkeepers include Alcoholic Beverages and Fashion & Accessories Retail. Bookkeepers in Alcoholic Beverages have the highest average annual salaries, while those in other sectors earn less.

Average bookkeeping salary

Although there is no national standard for bookkeeper salaries there are many variations within states and cities. Salaries in larger cities may be higher than those in smaller communities. As an example: A San Francisco bookkeeper is likely to earn more than a Bakersfield bookkeeper.

Job duties

Bookkeeping is a job requiring technical skills and knowledge in accounting systems. The job duties of a bookkeeper can vary from one location to the next. Because of this, the job description may vary. It is important to read the job description before applying to a position as a bookkeeper.

Experience

Bookkeeper salaries can vary greatly, depending on experience, location, and education. Some bookkeepers make more than others and can negotiate higher salaries. You can also make more money by studying at a higher level or getting management experience.

Lage

The salary of a bookkeeper depends on many factors. These include the place of work, education and level of experience. A bookkeeper can expect to make around $39,000 per annum or $20 an hour. An entry-level position in bookkeeping can earn you around $33,262, while a more experienced one could make you $53,625 per annum.

Certification

A certificate of completion for bookkeeping can make it easier for bookkeepers in their profession. Employers will be able to see that you have completed all required coursework to show their competency at the national level. Employers will be more inclined to promote you once you have earned this certification.

Hourly rate

If you're considering a career in bookkeeping, it's important to know that your salary will depend on your location and educational background. Bookkeepers are typically paid between $10 and $14 an hour. This can vary depending upon experience and the location. To give you an idea of average pay for this position, check out the following hourly rate table.

FAQ

What is the purpose accounting?

Accounting is a way to see a financial picture by recording, analyzing and reporting transactions between people. It allows companies to make informed decisions about their financial position, such as how much capital they have, what income they expect to generate from operations, or whether they need additional capital.

To provide information on financial activities, accountants record transactions.

This data allows the organization plan for its future business strategy.

It is essential that data be accurate and reliable.

What does it mean for accounts to be reconciled?

The process of reconciliation involves comparing two sets. The source set is called the “source,” while the reconciled set is called both.

The source consists of actual figures, while the reconciled represents the figure that should be used.

For example, if someone owes you $100, but you only receive $50, you would reconcile this by subtracting $50 from $100.

This ensures that there are no accounting errors.

How long does an accountant take?

To become an accountant, one needs to pass the CPA exam. The average person who wants to become an accountant studies for approximately 4 years before sitting for the exam.

After passing the test one must have worked for at minimum 3 years as an Associate before becoming a Certified Public Accountant (CPA).

What are the signs that my company needs an accountant?

When a company reaches a certain size, accountants are often hired. For example, a company needs one when it has $10 million in annual sales or more.

However, there are some companies that hire accountants regardless if they have a small business. These include sole proprietorships, partnerships and corporations.

A company's size doesn't matter. The only thing that matters is whether the company uses accounting systems.

If so, then the company should hire an accountant. A different scenario is not possible.

What is an Audit?

An audit is an examination of the financial statements of a company. To ensure everything is correct, an auditor reviews the company's financial statements.

Auditors are looking for discrepancies among what was reported and actually occurred.

They also make sure that the financial statements are correctly prepared.

What does an auditor do exactly?

Auditors look for inconsistencies within the financial statements with actual events.

He verifies the accuracy of all figures supplied by the company.

He also validates the validity and reliability of the company's financial statements.

Statistics

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

Accounting for Small Business: What is the best way to do it?

Accounting is an essential part of managing any business. This involves tracking income and expenses as well as preparing financial reports and tax payments. This task also requires the use of software programs, such as Quickbooks Online. There are many ways you can go about doing your accounting for small businesses. The best method for you depends on your needs. We have listed the best options for you below.

-

Use paper accounting. Paper accounting is a good option if you prefer simplicity. The process of using this method is very easy; you just need to record your transactions daily. You might consider investing in an accounting software like QuickBooks Online if you want your records to be accurate and complete.

-

Online accounting. Online accounting is a way to have easy access to your accounts no matter where you are. Wave Systems and Freshbooks are three of the most widely used options. These software programs allow you to manage finances, pay bills, generate reports, send invoices, and more. These programs offer many features and benefits. They also make it easy to use. These programs are a great way to save time and cash on your accounting.

-

Use cloud accounting. Cloud accounting is another option that you could use. It allows you secure storage of your data on a remote server. Cloud accounting is a better option than traditional accounting systems. Cloud accounting doesn't require expensive hardware and software. Second, it offers better security because all your information is stored remotely. It eliminates the need to back up your data. It makes it easy to share files with others.

-

Use bookkeeping software. Bookkeeping software is similar in function to cloud accounting. You will need to purchase a computer and then install the software. After installing the software, you will be able to connect to the internet so that you can access your accounts whenever you want. You will also be able view your balance sheets and accounts directly from your computer.

-

Use spreadsheets. Spreadsheets are used to enter your financial transactions manually. One example is a spreadsheet you can use to track your daily sales. A spreadsheet has the advantage of being able to modify them whenever you wish without needing a complete update.

-

Use a cash book. A cashbook is a ledger where you write down every transaction that you perform. Cashbooks come in different sizes and shapes depending on how much space you have available. You have the option of using a different notebook for each month, or a single notebook that covers several months.

-

Use a check register. Use a check register to keep track of receipts and pay bills. All you need to do is scan the items received into your scanner, and you can transfer them to your check register. You can also add notes to help you recall what you purchased.

-

Use a journal. A journal is a logbook which keeps track of your expenses. This is best for those who have recurring expenses like rent, insurance, and utilities.

-

Use a diary. You can simply use a diary to keep track of your life. You can use it to keep track of your spending habits and plan your budget.