This article will assist you in calculating the salary as a manager accountant. You can read on to find out about the average salary and education required for this career, as well as the job outlook. Then, start applying today to earn more than you ever thought possible. These tips will help you to get started on your career path. Just remember to do your research! And don't forget to share it with others!

Average salary range

The average salary for a manager accountant depends on the industry in which they work. Health Care, Information Technology and Construction are the highest-paying industries. The Professional industry is the least well-paid. Average salary for an Accountant & Office Manager is $44,187 annually. Below is an example of the average income for manager accountants. To get a job as a manager accountant, you need to have an education. There are no requirements to become an accountant manager, but there are some basics.

Factors that affect pay

An accounting manager should be aware the following factors that impact salary levels. The factors that impact the compensation level are education, experience, and geographic location. The short-term outlook for accountant jobs is positive in all U.S. states and territories. Only certain regions in the U.S. will grow over the long term. Therefore, the most favorable states for accountants include Utah and Georgia.

Perspectives for the future

The U.S. Bureau of Labor Statistics tracks salary growth for auditors and management accountants. This profession earns a median salary of $71,000 annually. The entry-level academic degree required for this job is a bachelor's. The future growth rate for management accountants is expected to be 4%. Accounting careers are very promising. To be eligible for a managerial accountant salary, you will need a bachelor's degree.

Education necessary

Management accountants can have many responsibilities. They should be familiar with accounting principles and GAAP. Their salaries are highly competitive. These professionals can hold special designations or specialize within specific areas. They can work for nonprofits, government agencies or private companies. They can also be called industrial, cost, and managerial accountants. They must be capable of analyzing financial data and preparing reports for internal use.

Experience required

The industry and the company that the accountant works for will determine the salary. The salary for this professional is between PS35,000 and PS100,000. It could be higher or lower depending upon the level of experience. The Bureau of Labor Statistics provides information on the salary of this professional. This includes the required experience and the complexity of the job. The National Compensation Survey also includes information about the manager's company and work environment. Alere Laboratories was ranked as the highest-paid company. Milliman salary data reports very competitive wages for Accountant and Office Managers.

FAQ

What is the average time it takes to become an accountant

To become an accountant, one needs to pass the CPA exam. Most people who wish to become accountants study for around 4 years before taking the exam.

After passing the exam, one must be an associate for at most 3 years in order to become a certified public accounting (CPA) after passing it.

Accounting: Why is it useful for small-business owners?

The most important thing you need to know about accounting is that it's not just for big businesses. Accounting is beneficial to small business owners as it helps them keep track and manage all the money they spend.

If you own a small business, then you probably already know how much money you have coming in each month. But what happens if you don’t have a professional accountant to help you with this? You might be wondering about your spending habits. Or you could forget to pay bills on time, which would hurt your credit rating.

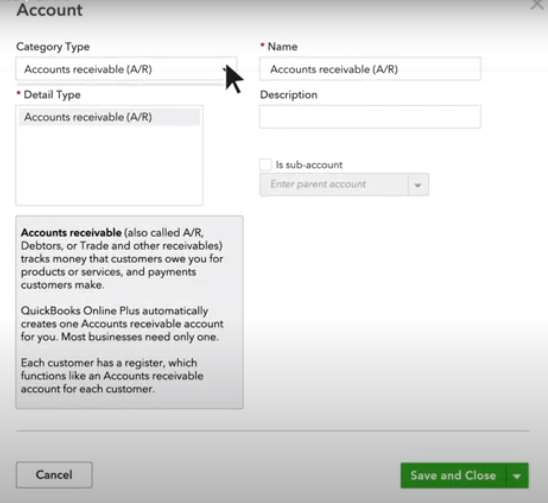

Accounting software makes managing your finances simple. There are many choices. Some are absolutely free while others may cost hundreds or even thousands of dollars.

However, regardless of the type of accounting software you choose, you will need to be familiar with its basics. By doing this, you will not waste time learning how to operate it.

These three tasks are essential.

-

Enter transactions into the accounting system.

-

Track your income and expenses.

-

Prepare reports.

Once you have these three skills, you are ready to begin using your new accounting program.

How Do I Know If My Company Needs An Accountant?

Many companies hire accountants after reaching certain levels. For example, a company needs one when it has $10 million in annual sales or more.

However, there are some companies that hire accountants regardless if they have a small business. These include small companies, sole proprietorships as well partnerships and corporations.

A company's size doesn't matter. Only important is the use of accounting systems.

If it does, the company will need an accountant. If it doesn’t, then it shouldn’t.

What is the difference in accounting and bookkeeping?

Accounting is the study and analysis of financial transactions. The recording of these transactions is called bookkeeping.

These two activities are closely related, but distinct.

Accounting deals primarily with numbers, while bookkeeping deals primarily with people.

For reporting purposes on an organization's financial condition, bookkeepers keep financial records.

They make sure all of the books balance by adjusting entries in accounts payable, accounts receivable, payroll, etc.

Accounting professionals examine financial statements to determine if they are in compliance with generally accepted accounting principles.

If not, they may recommend changes to GAAP.

So that accountants can analyze the data, bookkeepers keep records about financial transactions.

Are accountants paid?

Yes, accountants usually get paid hourly rates.

For complex financial statements, some accountants may charge more.

Sometimes accountants are hired to perform specific tasks. An example of this is a public relations firm that might hire an accountant for a report on how the client is doing.

What are the benefits of accounting and bookkeeping?

Bookkeeping and accounting are important for any business. They can help you keep track if all your transactions are recorded and what expenses were incurred.

They also help you ensure you're not spending too much money on unnecessary items.

You should know how much profit your sales have brought in. Also, you will need to know how much debt you owe other people.

You can raise your prices if you don’t have enough cash coming in. Customers might be turned off if prices are raised too high.

You might consider selling off inventory that is larger than you actually need.

If you don't have enough, you can cut back on some services or products.

These things can have a negative impact on your bottom line.

Statistics

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to be an Accountant

Accounting is the science behind recording transactions and analysing financial data. Accounting also includes the preparation of statements and reports for different purposes.

A Certified Public Accountant, also known as a CPA, is someone who has successfully passed the CPA exam. They are licensed by the state's board of accountancy.

An Accredited Finance Analyst (AFA), an individual who meets certain requirements established by the American Association of Individual Investors. A minimum of five years investment experience is required to become an AFA by the AAII. To pass the examinations, they must have a good understanding of accounting principles.

A Chartered Professional Accountant is also known by the name chartered accountant. This is a professional accountant who received a degree at a recognized university. The Institute of Chartered Accountants of England & Wales (ICAEW) has established specific educational standards for CPAs.

A Certified Management Accountant or CMA is a professionally certified accountant who specializes only in management accounting. CMAs must pass exams administered by the ICAEW and maintain continuing education requirements throughout their career.

A Certified General Accountant (CGA) member of the American Institute of Certified Public Accountants (AICPA). CGAs are required to take several tests; one of these tests is known as the Uniform Certification Examination (UCE).

International Society of Cost Estimators' (ISCES) offers the Certified Information Systems Auditor certification. The three-level curriculum for CIA candidates includes practical training, coursework, and a final exam.

Accredited Corporate Compliance Official (ACCO), a title granted by ACCO Foundation and International Organization of Securities Commissions. ACOs must possess a Bachelor's Degree in Finance, Business Administration, Economics, or Public Policy. They must pass two written exams, and one oral exam.

The National Association of State Boards of Accountancy gives the credential of Certified Fraud Examiner (CFE). Candidates must pass three exams with a minimum score 70 percent.

International Federation of Accountants is accredited a Certified Internal Audior (CIA). Candidates must pass four exams covering topics such as auditing, risk assessment, fraud prevention, ethics, and compliance.

American Academy of Forensic Sciences' (AAFS), designates Associate in Forensic Analysis (AFE). AFEs need to have graduated from an accredited college/university with a bachelor's level in any other field than accounting.

What does an auditor do? Auditors are professionals who perform audits of financial reporting systems and their internal controls. Audits can either be done randomly or based on complaints about financial statements received by regulators.