You may have wondered what it takes to be a bookkeeper. Maybe you've wondered what it takes to be a bookkeeper, or how to get started. You can get professional help if you want to start a bookkeeping career or simply earn more. Read on to learn more about the job, the education requirements, and compensation. Regardless of your reasons, you'll be glad you took the time to learn about this profession.

Your job duties

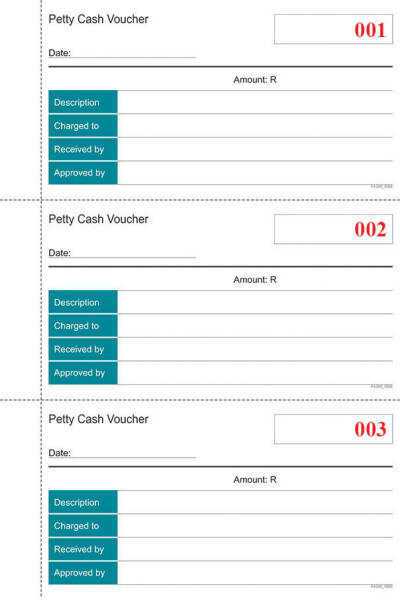

A bookkeeper's job duties include reconciling accounts, reconciling financial statements, reporting, and balancing the ledgers. In order to be successful in this fast-paced job, you must have excellent organizational skills, confidentiality, and accuracy. They may also be responsible for accounts payable and receivable management, as well as reconciling bank accounts and maintaining petty cash accounts. A bookkeeper can also perform other tasks such as completing sales tax payments.

Although bookkeepers are expected to have a minimum of a bachelor's, some may be qualified without one. Some employers might offer entry-level job opportunities that do not require a high school diploma. Other qualifications may be required for bookkeepers, such as certifications through organizations like the Association of Certified Public Bookkeepers. Additional training may include accounting or finance. Businesses will often request certain qualifications such as relevant work experience in job postings.

Education is required

For a career in bookkeeping, an associate's/bachelor's degree may not be necessary. Many times, a high school education suffices. This type of degree provides aspiring bookkeepers with the basic math, writing, and communication skills that employers seek. Furthermore, it helps them gain relevant time management, organization, and teamwork skills. However, a bachelor's degree may be helpful for advancement.

A bookkeeper must be proficient in basic math. While spreadsheets are useful, you don’t have to be an expert. It is important to be able interpret data from software and to manage your time effectively. Most clients expect their bookkeepers to use accounting software to keep track of their accounts. You should also be able to learn new software. Most employers are looking for people who have experience in a certain industry or have certification.

Compensation

Based on the level of experience, compensation for bookkeepers varies widely. Bookkeepers often work as independent contractors and are paid between $20 and $70 per hour. Bookkeepers in high-paying fields are those who work in financial services and the energy sector. Bookkeepers who work with companies with more complex business models usually earn more. A bookkeeper's hourly rate should be between $20-40.

Over the next few decades, the national demand of bookkeepers is expected decrease. However, bookkeeper openings in some states like Arizona, Utah, Delaware, and Texas are expected to grow by as much at 4% over ten years. In contrast, Florida, Maryland, and Nevada are expected to see growth of about 7.9%. San Francisco and Boston are the top cities for bookkeepers. If you're interested in this career, it is a good idea to attend school to acquire the skills.

FAQ

What is bookkeeping?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. It also includes the recording of all business-related income and expenses.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They also prepare tax returns and other reports.

What should I expect from an accountant when I hire them?

When hiring an accountant, ask questions about their experience, qualifications, and references.

You need someone who is experienced in this type of work and can explain the steps.

Ask them about any skills or knowledge they may have that could be of assistance to you.

Make sure they have a good reputation in the community.

What's the purpose of accounting?

Accounting provides an overview of financial performance by measuring, recording, analyzing, and reporting transactions between parties. Accounting allows organizations to make informed decisions about how much money they have available to invest, how much they can expect to earn from operations and whether additional capital is needed.

Accountants keep track of transactions to provide information about financial activities.

The organization can use the data to plan its future budget and business strategy.

It's essential that the data is accurate and reliable.

What is an audit?

An audit is a review of a company's financial statements. Auditors examine the accounts of a company in order to make sure everything is correct.

Auditors search for discrepancies between the reported events and the actual ones.

They also check whether the company's financial statements are prepared correctly.

What is a Certified Public Accountant and how do they work?

Certified public accountant (C.P.A.). An accountant is someone who has special knowledge in accounting. He/she can prepare tax returns for businesses and assist them in making sound business decisions.

He/She keeps an eye on the company's cash flow, and ensures that everything runs smoothly.

Statistics

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

External Links

How To

Accounting for Small Businesses: What to Do

Accounting for small businesses should be one of your most important tasks when managing a business. Accounting involves keeping track of income, expenses, creating financial reports and paying taxes. It also involves the use of various software programs such as Quickbooks Online. There are many ways you can go about doing your accounting for small businesses. You should choose the best way for you according to your needs. Below are the top choices.

-

Use paper accounting. Paper accounting is a good option if you prefer simplicity. This method is very simple. All you need to do is keep track of all transactions. A QuickBooks Online accounting program is a good option if your records need to be complete and accurate.

-

Online accounting. Online accounting makes it easy to access your accounts anywhere, anytime. Some popular options include Xero, Freshbooks, and Wave Systems. These software are great for managing your finances, sending invoices and paying bills. They offer great features and benefits, and they are easy to use. So if you want to save time and money when it comes to accounting, you should definitely try out these programs.

-

Use cloud accounting. Another option is cloud accounting. Cloud accounting allows you to securely store your data on remote servers. When compared to traditional accounting systems, cloud accounting has several advantages. Cloud accounting isn't dependent on expensive software or hardware. You have better security since all your information can be accessed remotely. It also saves you time and effort in backing up your data. Fourth, you can share your files with others.

-

Use bookkeeping software. Bookkeeping software works in the same way as cloud accounting. However, you will need to buy a computer to install the software. After you install the software, you'll be able connect to the internet and access your accounts whenever you wish. You will also be able view your balance sheets and accounts directly from your computer.

-

Use spreadsheets. Spreadsheets can be used to manually enter financial transactions. To illustrate, you could create a spreadsheet in which you can record your sales figures daily. Another benefit of using a spreadsheet is the ability to make changes at will without needing an entire update.

-

Use a cash book. A cashbook lets you keep track of every transaction. Cashbooks come in different sizes and shapes depending on how much space you have available. Either keep a separate notebook each month, or you can use one notebook that covers multiple months.

-

Use a check register. A check register is a tool that helps you organize receipts and payments. Simply scan your items into your scanner to transfer them to the check register. Notes can be added to the items once they are scanned.

-

Use a journal. A journal is a logbook which keeps track of your expenses. If you have many recurring expenses, such as rent, insurance, or utilities, this journal is the best.

-

Use a diary. A diary is simply a journal that you write to yourself. You can use it for tracking your spending habits or planning your budget.