Consider all options before deciding whether a finance degree would be right for you. The Bureau of Labor Statistics predicts that the field will grow at five percent per year by 2029. This rate is higher than the average for all occupations. After graduation, you should have job security and lots of career opportunities.

Alternatives to a finance degree

It is possible to have trouble finding work after earning your finance diploma. Whether you've had enough experience in the field or you have lost interest in the financial markets, there are other career paths to consider. These options are often rewarding and can help you uncover your talents and interests. You will feel a sense of purpose and self-worth through these alternative routes.

Other options for a finance education include positions in insurance, public accounting and hedge funds, as well as finance consulting. You might even be able get a job in regulatory compliance, financial analyst, and quantitative analyst. These jobs can be very difficult to find and pay well.

Finance degrees are a requirement for many financial positions. However for those who don't want to study finance, there is an alternative. These jobs require an analytical skill set and the ability to learn. You will also learn the soft skills necessary for many other career options.

After a finance degree, there are many career options

After completing a finance degree, there are many job opportunities. This field offers one of highest salaries, with even entry-level roles in finance paying more than the median. You might want to pursue a PhD in finance if you are interested in the highest possible pay in a particular field.

You can work in finance for either government agencies, investment firms, or corporations. You'd manage budgets and analyze spending in these positions. You can also work as a financial advisor with individuals and their families. This role would include managing all financial matters of individuals and their families, including investment strategy, debt management and tax planning.

Finance professionals are highly sought after in all industries, including government, health care, entertainment and government. And their demand is projected to grow at 4% in the US over the next four years. Additionally, financial professionals are crucial to almost any organization.

Financial degree cost

A finance degree is necessary to be able to enter any profession that requires knowledge in financial markets and money. You'll be able to learn about different investment options, including risk and return. Additionally, you will be able to use spreadsheets in order to analyze key business performance metrics. You'll also become familiar with economics, accounting, and other related fields. You might study taxation or corporate finance, or the relationship between money & society.

A bachelor's level in finance takes approximately four years. The program includes courses in statistics, math, and business. The cost of an undergraduate finance degree can vary from $24,000 up to $75,000. Before enrolling, be sure you know the total costs. An online finance degree is a great way to save money and allow you to balance work and study.

The cost of a degree in finance depends on many factors including the university you choose. For example, some colleges charge more for undergraduate degrees than for graduate programs, while others charge less. To cut down on costs, you may be able take courses in the summer or enroll in dual enrollment. Financial aid may be available to help pay for your degree.

FAQ

What are the different types of bookkeeping systems?

There are three types of bookkeeping systems available: computerized, manual and hybrid.

Manual bookkeeping means using pen and paper to maintain records. This method requires constant attention.

Computerized bookkeeping uses software programs to manage finances. This saves time, effort, and money.

Hybrid bookkeeping is a combination of both computerized and manual methods.

How can I get started keeping books?

To start keeping books, you will need some things. These are a notebook with a pencil, calculator, printer and stapler.

What happens if I don't reconcile my bank statement?

If you fail to reconcile your bank statement, you may not realize that you've made a mistake until after the end of the month.

Then, you will need to start all over again.

What is an accountant's role and why does it matter?

An accountant keeps track and records all the money you spend and earn. They keep track of how much tax is paid and allowable deductions.

An accountant will help you manage your finances, keeping track of both your incomes as well as your expenses.

They help prepare financial reports for businesses and individuals.

Accounting is a necessity because accountants must know all about numbers.

In addition, accountants help people file taxes and ensure they're paying as little tax as possible.

How can I find out if my business needs an accountant

Companies often hire accountants once they reach certain sizes. One example is a company that has annual sales of $10 million or more.

However, not all companies need accountants. These include sole proprietorships, partnerships and corporations.

A company's size doesn't matter. Only important is the use of accounting systems.

If so, then the company should hire an accountant. It doesn't if it doesn't.

What is bookkeeping and how do you define it?

Bookkeeping is the art of keeping records of financial transactions for individuals, businesses, and organizations. It involves recording all business-related income as well as expenses.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They also prepare tax returns and other reports.

How long does it take for an accountant to become one?

To become an accountant, one needs to pass the CPA exam. Most people who are interested in becoming accountants have studied for at least 4 years before taking the exam.

After passing the exam, one must be an associate for at most 3 years in order to become a certified public accounting (CPA) after passing it.

Statistics

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

External Links

How To

The Best Way To Do Accounting

Accounting is a system of processes that allows businesses to accurately record transactions and keep track of them. It includes recording income and expenses, keeping records of sales revenue and expenditures, preparing financial statements, and analyzing data.

It also involves reporting financial results to stakeholders such as shareholders, lenders, investors, customers, etc.

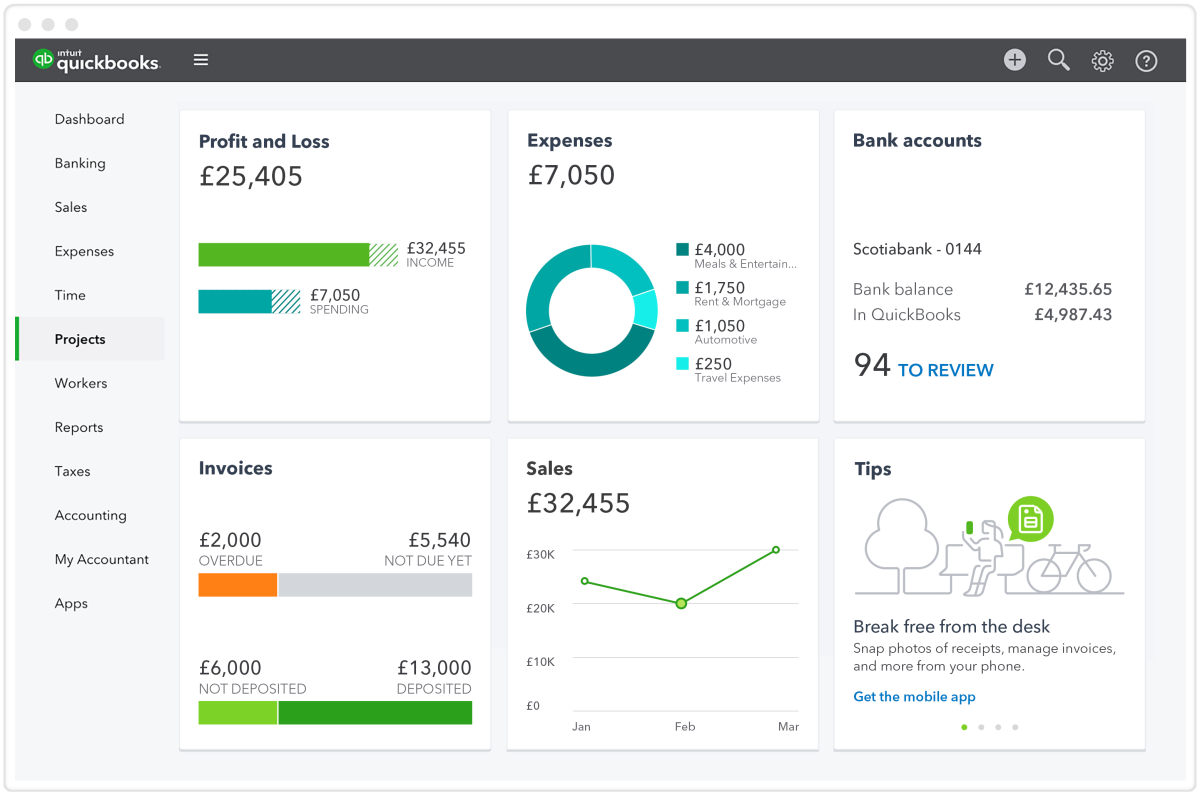

Accounting can be done in many ways. There are several ways to do accounting.

-

Create spreadsheets manually

-

Excel can be used.

-

Notes handwritten on paper

-

Computerized accounting systems.

-

Online accounting services.

Accounting can be done in many different ways. Each method comes with its own set of advantages and disadvantages. Which one you choose will depend on your business model, needs and preferences. Before you decide to use any of these methods, make sure you consider their pros and cons.

Accounting is not only efficient but also has other benefits. For example, if you are self-employed, you might want to keep good books because they provide evidence of your work. Simple accounting techniques may work best for small businesses, especially if they don't have much money. However, complex accounting may be more appropriate for businesses that generate large amounts of cash.