Accountants prepare, analyze, maintain and update financial records. They are employed by companies, government agencies, and individual clients. Accountants have excellent organizational, communication, problem-solving and communication skills. Many people also choose to work from their homes and get the autonomy and flexibility that an accounting career allows. This article discusses some of the benefits this field offers. You can read on to learn about the career options and how to start!

Accountants prepare, analyze, and maintain financial records

The profession of accountants focuses on preparing, analyzing, and maintaining financial records. Some accountants have specialized knowledge in particular industries, such law and government. Forensic accountants analyze business financial records and investigate fraud and other financial crimes. They assist with both internal and externe audits. This field also includes financial crime investigations, including embezzlement and securities fraud.

Most accountants work in a office environment. However, some accountants might need to travel to audit financial records or to visit clients. For example, accountants may prepare tax returns for government entities and other companies. Other duties include auditing financial records and creating budget data. Many also perform general office work. Here are some common occupations held by accountants. Continue reading to learn more about this rewarding career.

They are available to work for individual clients, governments and companies.

Many people believe that an accounting career is only for those who enjoy analysing and organizing large quantities of financial data. Accounting professionals can have many responsibilities. However, they may also be chief financial officers. This involves giving advice and direction to clients, government agencies and companies. Accounting is a career that many people pursue to be competitive in the job marketplace.

There are many different types of accounting careers. Each branch of the field requires a different level of education. Some accounting jobs require certifications or additional education. It is important that you understand the differences in these roles to ensure that you are able choose the right job for your career goals. The following are some of the types of jobs in accounting. There are many types of accounting jobs. You can choose to focus on taxation, corporate accounting, or government accounting.

They possess strong organizational, communication, problem-solving, and communication skills

The Bureau of Labor Statistics tracks the employment of accountants. There are many types and levels of finance and accounting jobs. They include tax preparation, accounting and manufacturing. In addition, accountants often deal with various kinds of software, such as spreadsheets and general ledger functions. Candidates must be able to communicate and interact well with others. They should also have exceptional analytical and problem-solving capabilities. Candidates should have a keen eye for detail and strong organizational skills.

People who are interested in an accounting career need to know what their strengths and where they can improve. These skills can be used to your advantage in any accounting job, no matter if you are a math genius or an expert at problem solving. This field requires that people spend considerable time analysing financial statements and reconciling bookkeeping ledgers. For clients and colleagues to be able talk to you, it is essential that you have good communication skills.

They can also work remotely

Accounting professionals have many options for work-from-home jobs. You will require a computer, an internet connection, and a dedicated line. It is possible that you will also require a headset, a printer and a scanner. A multifunction device, however, can save you money. An accounting software package will be required to allow you to complete all tasks.

FlexJobs, a great place for finding a job in the accounting field, is a great option. FlexJobs specializes in remote job opportunities, including full-time, entry-level and part-time positions. Take a free tour and get a feel of the system before you make a payment. FlexJobs can be used to help you find at-home accounting jobs. Visit the company's site to learn more about its various services and features.

FAQ

What does it mean for accounts to be reconciled?

It involves comparing two sets. The source set is called the “source,” while the reconciled set is called both.

The source consists of actual figures, while the reconciled represents the figure that should be used.

If someone owes $100 but you receive only $50, this would be reconciled by subtracting $50 from $100.

This process ensures that there aren't any errors in the accounting system.

What does an accountant do and why is it important?

An accountant keeps track and records all the money you spend and earn. They also record how much tax you pay and what deductions are allowable.

An accountant will help you manage your finances, keeping track of both your incomes as well as your expenses.

They are responsible for preparing financial reports that can be used by individuals or businesses.

Accountants are essential because they need to understand everything about numbers.

A professional accountant can also help with taxes, so that people pay as little tax as they possibly can.

What is an auditor?

Auditors look for inconsistencies between financial statements and actual events.

He confirms the accuracy and completeness of the information provided by the company.

He also checks the validity of financial statements.

What is the purpose of accounting?

Accounting gives an overview of financial performance. It measures, records, analyzes, analyses, and reports transactions between parties. It allows companies to make informed decisions about their financial position, such as how much capital they have, what income they expect to generate from operations, or whether they need additional capital.

Accountants track transactions in order provide financial activity information.

The organization can use the collected data to plan its future strategy and budget.

It is important that the data you provide be accurate and reliable.

Statistics

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

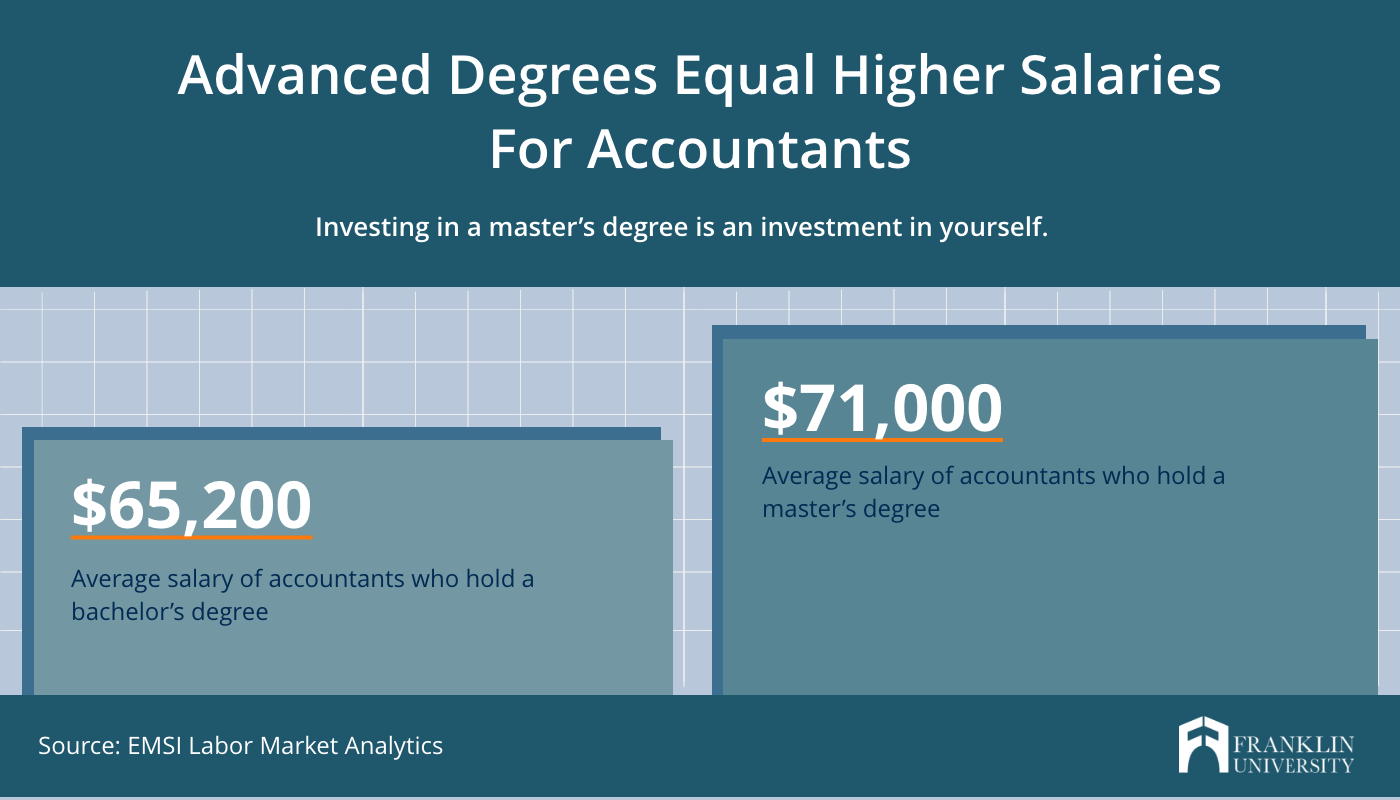

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to do your bookkeeping

There are many types of accounting software available today. While some software is free and some cost money to purchase, many offer basic functions such as billing, invoicing, inventory management, payroll, point-of sale, financial reporting, and processing of payroll. Here is a list of the most commonly used accounting packages.

Free Accounting Software: Most accounting software is free and available for personal use. While it might not be as functional as you would like (e.g. you cannot create reports), the software is usually very simple to use. Many free programs also allow you to download data directly into spreadsheets, making them useful if you want to analyze your business's numbers yourself.

Paid accounting software: Paid accounts can be used by businesses with multiple employees. These accounts are powerful and can be used to track sales and expenses and generate reports. Most paid programs require at least one year's subscription fee, although there are several companies offering subscriptions that last less than six months.

Cloud Accounting Software: You can access your files from anywhere online using cloud accounting software. This type of program has become increasingly popular because it saves you space on your computer hard drive, reduces clutter, and makes working remotely much easier. You don't even need to install any additional software. You only need an internet connection and a device that can access cloud storage services.

Desktop Accounting Software is a version of cloud accounting software that runs on your local computer. Like cloud software, desktop software lets you access your files from anywhere, including through mobile devices. However, unlike cloud-based software, desktop software must be installed on your computer before it can be used.

Mobile Accounting Software is designed to run on smaller devices, such as tablets and smartphones. These programs enable you to manage your finances even while you're on the move. They have fewer functions that full-fledged desktop apps, but they're still extremely useful for people who travel often or run errands.

Online Accounting Software: Online accounting software is designed primarily for small businesses. It includes everything that a traditional desktop package does plus a few extra bells and whistles. Online software doesn't need to be installed. All you have to do is log on and get started using it. You can also save money and avoid the overheads of a local office.