Accounting is an essential business tool that managers use to plan, manage, and report financial activities. It is a discipline which combines economics with business administration courses to prepare students and post-graduate students for careers in the field. The degree provides excellent preparation for a Masters of Business Administration program. Students will learn to apply accounting concepts within analysis-based business coursework. MBA and MAcc programs both require students to complete internships.

MBA

You're not the only one thinking of getting an MBA in Accounting. As the world economy and business landscape evolves, this type of graduate program becomes more common. In addition to advancing your accounting knowledge, you can also gain valuable management skills. Learn more about your school's MBA program and decide if this is the right career path for you. Here are some tips to help you learn more about the MBA accounting program.

The UD MBA Accounting program is designed to meet the needs of working professionals who hold full-time positions. The curriculum includes classroom instruction and a capstone consulting experience. Students take classes from practicing scholars and develop skills in financial accounting, including the ability to analyze and interpret financial statements. The MBA program at UD can be accessed from anywhere in the world. It is affordable and flexible. Students pay the same tuition regardless their residency status. An online program may be a good option if you want to get an MBA in accounting, but also have other professional goals.

MAcc

An MAcc degree is a graduate degree in accounting that prepares students for a variety of positions in the field. Graduates are highly sought after in public and private accounting firms. A master's program in accounting is also required for entry to consulting. The MAcc program includes coursework that spans the fall, spring, and summer and culminates in an MAcc degree in August. The program requires students to complete four sections by the end of their second years, although it is highly encouraged that they do so as soon as October.

The MAcc program can be taken as either a 3-1/2-year or traditional program. Classes are held on weekdays in the evenings. For all graduate coursework, students must maintain a minimum 3.0 GPA. This includes courses in accounting. A grade of less than a "C" in any course will not be accepted for graduate credit towards the MAcc degree. Students with more "C" than two grades may be disqualified from the program.

Master's degree for accounting

The Master's in Accounting program is designed to prepare students for the demands of the fast-paced accounting field. It brings students in contact with like-minded professionals and prepares them for managerial roles. Graduates of this program can expect to have a variety career opportunities in the field. These include CPA certification, financial planning, and budget analysis. This program provides students with networking and professional growth opportunities.

Each institution has its own admission requirements for Master's degrees in accounting. In most cases, applicants need to have completed a bachelor's level in accounting. Some programs require prerequisite classes, while others don't. Some programs may require work experience, but most schools will accept work experience in the same field. Many accounting masters programs require you to take the GMAT. However a score above 500 is usually enough.

FAQ

What is an Audit?

An audit involves a review and analysis of a company's financial statements. Auditors examine the financial statements of a company to verify that they are correct.

Auditors check for discrepancies and contradictions between what was reported, and what actually occurred.

They also check whether the company's financial statements are prepared correctly.

What is the purpose of accounting?

Accounting is a way to see a financial picture by recording, analyzing and reporting transactions between people. Accounting allows organizations make informed decisions about how much money to invest, how likely they are to earn from their operations, and whether or not they need to raise additional capital.

Accountants keep track of transactions to provide information about financial activities.

The data collected allows the organization to plan its future business strategy and budget.

It is vital that the data are reliable and accurate.

What is the distinction between bookkeeping or accounting?

Accounting studies financial transactions. Bookkeeping is the recording of those transactions.

Both are connected, but they are distinct activities.

Accounting deals primarily with numbers, while bookkeeping deals primarily with people.

Bookkeepers record financial information for purposes of reporting on the financial condition of an organization.

They ensure that all the books are balanced by correcting entries for accounts payable, accounts receivable or payroll.

Accountants review financial statements to determine compliance with generally accepted Accounting Principles (GAAP).

If they are unsure, they might recommend changes in GAAP.

Accounting professionals can use the financial transactions that bookkeepers have kept to analyze them.

What is bookkeeping?

Bookkeeping can be described as the keeping of records about financial transactions for individuals, businesses and organizations. It also includes the recording of all business-related income and expenses.

Bookkeepers maintain financial records such as receipts. They also prepare tax returns as well other reports.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

External Links

How To

How to get an accounting degree

Accounting is the act of recording financial transactions. It records transactions made by individuals, governments, and businesses. The term "account" means bookkeeping records. These data are used by accountants to create reports that help companies or organizations make decisions.

There are two types if accountancy: general (or corporate), and managerial. General accounting is concerned in the measurement and reporting on business performance. Management accounting is concerned with measuring, analysing, and managing organizations' resources.

A bachelor's in accounting can prepare students to work as entry-level accountants. Graduates can choose to specialize or study areas such as finance, taxation, management, and auditing.

If you are interested in a career as an accountant, you will need to have a basic understanding of economic concepts, such as supply, demand, cost-benefit analysis. Marginal Utility Theory, consumer behavior. Price elasticity of demande and the law of one. They must also understand microeconomics, macroeconomics, international trade, accounting principles, and various accounting software packages.

A Master's degree is available for students who have completed at most six semesters of college courses. Graduate Level Examinations are required for all students. This examination is normally taken after students have completed three years of education.

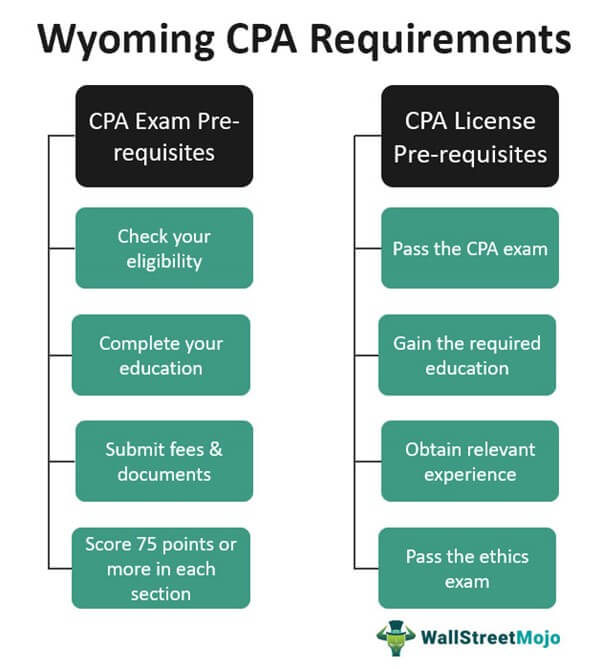

For certification as public accountants, candidates must have completed four years of undergraduate and four year of postgraduate education. The candidates must pass additional exams before being eligible to apply for registration.