The job of a budget analyst in a company is to assess the financial plans to determine if funds are being allocated properly and if expenditures are justified. You will need to have good math skills and good writing skills to get management approval for this job. The job of budget analyst has many benefits. Here are some of these benefits. This career path requires proficiency in the English language.

Budget analysts have a good job outlook and a higher salary, but the government's slowdown is predicted to cause a flattening of employment growth in the near future. However, the job is not as difficult as it sounds - you can get an education in economics, finance, and accounting. The U.S. Bureau of Labor Statistics (BLS) has a description of a job for a budget analyst.

Depending on the employer, the education requirement for a budget analyst may vary. While a bachelor's degree is required from an accredited college, university or college, some employers prefer a masters degree. You can also pursue a master’s degree in accounting or a related field if you have previous work experience to increase your chances for a job at a higher level. While a master's in accountancy is not required, it can help you land a job at the budget analyst level.

To become a budget analyst, you need to have excellent problem-solving and analytical skills. Also, you will need to have excellent communication skills and mathematical abilities. As a budget analyst, you will be expected to be able to work under pressure and be detail-oriented. You'll need to have many years of experience as a budget analyst. You will be required to work fast and efficiently under pressure.

If you are interested to become a budget analyst in government, you should get your Certified Government Financial Manager (CGFM). This credential demonstrates your expertise in financial management and governmental accounting. To obtain it, you will need to fulfill certain educational requirements, work two years in the field, take several exams, and meet certain academic requirements. You will also need to complete 80 hours of continuing education each year.

Budget analysts analyze the company's budget to determine how to improve efficiency and maximize profits. A budget analyst's primary focus is to determine the most efficient allocation of funds. Budget analysts tend to be conservative, organized, and well-organized. However, some budget analysts can be creative, assertive and optimistic. The job description is an important part in job application. Employers can use the job description as a guide to help them choose the best candidates for the position.

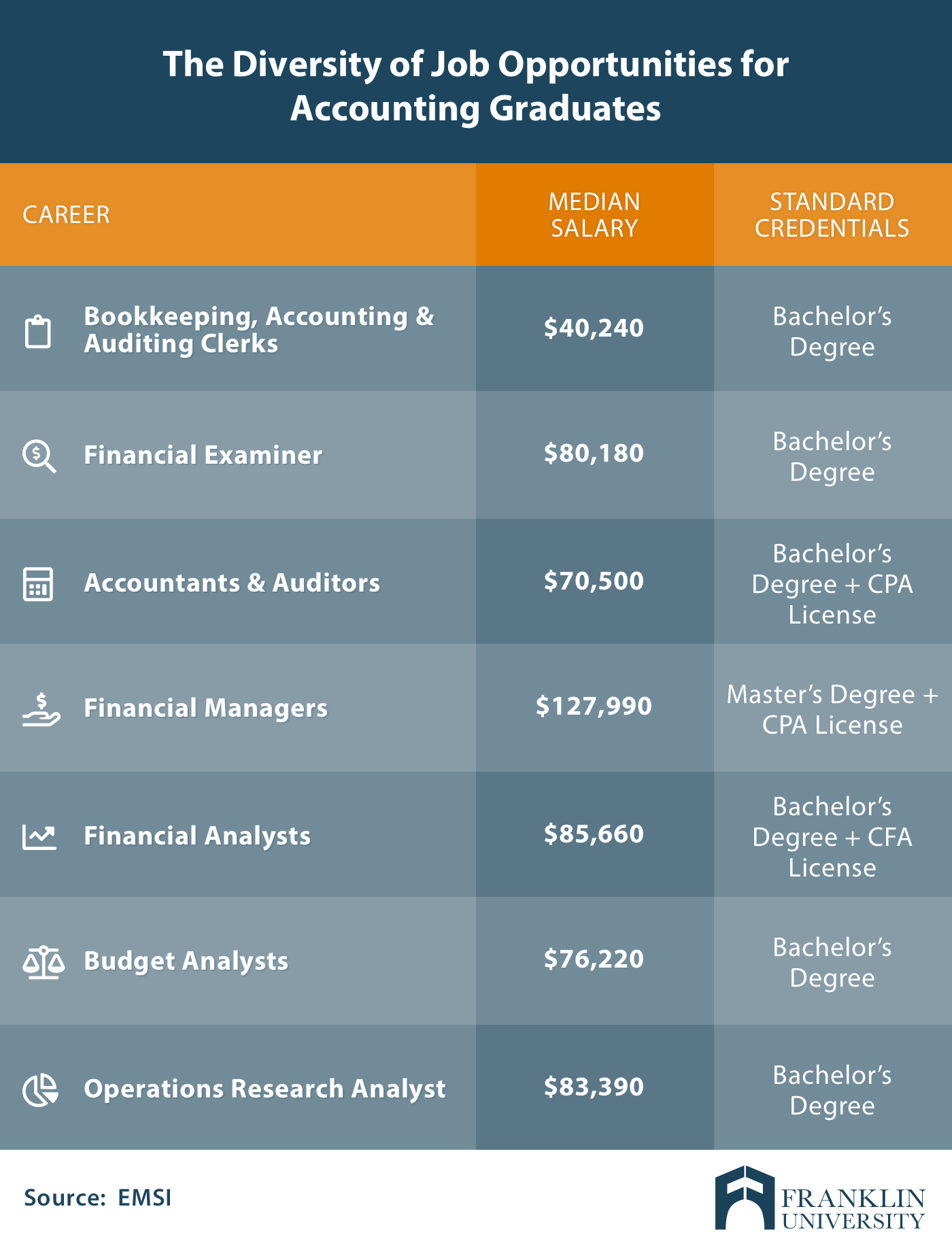

While the annual salary of a budget analyst may vary depending on where they work, it is most likely to be around $76,540. Budget analysts can earn a variety of salaries depending on where they work and what education level they have. Employers value advanced skills and training. Specialization can allow them to make a lot more money. They can also count on a steady job for at least a few years. Consider becoming a budget analysts if your skills are good with numbers!

FAQ

What is the difference between bookkeeping and accounting?

Accounting studies financial transactions. The recording of these transactions is called bookkeeping.

These two activities are closely related, but distinct.

Accounting deals primarily using numbers, while bookskeeping deals primarily dealing with people.

Bookkeepers record financial information for purposes of reporting on the financial condition of an organization.

They adjust entries in accounts receivable and accounts payable to make sure that the books balance.

Accountants analyze financial statements to determine whether they comply with generally accepted accounting principles (GAAP).

If they don't, they might suggest changes to GAAP.

Accounting professionals can use the financial transactions that bookkeepers have kept to analyze them.

How long does it usually take to become a certified accountant?

The CPA exam is necessary to become an accountant. Most people who wish to become accountants study for around 4 years before taking the exam.

After passing the exam, one must be an associate for at most 3 years in order to become a certified public accounting (CPA) after passing it.

What is bookkeeping?

Bookkeeping is the act of keeping track of financial transactions, whether they are for individuals or businesses. It includes all business expenses and income.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They also prepare tax returns and other reports.

What's the significance of bookkeeping & accounting?

Bookkeeping and accounting are important for any business. They enable you to keep track all of your expenses and transactions.

They also make it easier to save money on unnecessary purchases.

You should know how much profit your sales have brought in. It is also important to know how much you owe others.

You might consider raising your prices if you don't have the money to pay for them. However, if your prices are too high, customers might not be happy.

You might consider selling off inventory that is larger than you actually need.

If you have less than you need, you could cut back on certain services or products.

All these things will have an impact on your bottom-line.

What does an accountant do? Why is it so important to know what they do?

An accountant keeps track on all the money you make and spend. They keep track of how much tax is paid and allowable deductions.

An accountant can help you manage your finances and keep track of your incomes and expenses.

They assist in the preparation of financial reports for both individuals and businesses.

Accountants are necessary because they must be knowledgeable about all things numbers.

Accounting also assists people in filing taxes and ensuring that they pay as little as possible tax.

How do accountants work?

Accountants partner with clients to help them get the most out their money.

They also work closely with professional such as attorneys, bankers or auditors.

They also assist internal departments such as human resources, marketing, sales, and customer service.

Accountants are responsible to ensure that the books balance.

They determine the tax due and collect it.

They also prepare financial statements which show how well the company is performing financially.

Why is reconciliation important

It is vital because mistakes can happen at any time. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems could have severe consequences, such as incorrect financial statements, missed deadlines or overspending.

Statistics

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

External Links

How To

The Best Way To Do Accounting

Accounting refers to a series of processes and procedures that enable businesses to accurately track and record transactions. It includes recording income and expenses, keeping records of sales revenue and expenditures, preparing financial statements, and analyzing data.

It involves reporting financial results on behalf of stakeholders, such as shareholders and lenders, investors, customers, or other parties.

Accounting can be done in many ways. There are many ways to do accounting.

-

You can also create spreadsheets manually.

-

Excel software.

-

Notes for handwriting on paper

-

Using computerized accounting systems.

-

Online accounting services.

There are many ways to do accounting. Each method has advantages and disadvantages. Which one you choose depends on your business model and needs. You should always consider the pros and cons before choosing any method.

In addition to being efficient, there are other reasons you may decide to use accounting methods. Good books can prove your work if you are self-employed. Simple accounting may be best for small businesses that don't have a lot of money. However, complex accounting may be more appropriate for businesses that generate large amounts of cash.