Controllers are a vital part of a company’s financial department. These senior leaders should be skilled in tax and accounting matters. They must be able to inspire others, lead and take over a company’s books. Aside from their job, they must be skilled at self-management as they are required to implement company policies.

Business controllers

A business controller is a person who specializes in the financial management of a company. This job requires communication and analytical skills. They must also be able convert financial data into understandable terms that are easy to comprehend for non-financial staff. While experience with financial reporting systems is an advantage, it can also be learned on-the-job. Business controllers have many responsibilities. Some roles may require more traveling than others. Business controllers typically work full-time, and are subject to high stress. They are often required to make quick decisions, which can have significant implications for their employer.

Recent years have seen controllers re-dedicated towards helping organizations improve their performance, and adding value. Controllers spend more time on business productivity and strategic initiatives than balancing accounting and financial functions. They are also using their knowledge of business analytics to identify high-profit customers.

Regulatory controllers

The controller's job is to make sure that the organization's finances are in order and that all financial information is compliant with regulatory requirements. This job requires a high level of analytical skills. People who excel at this role should have an accounting background. Additionally, this role requires an ability to work with data. It can be both challenging and rewarding, even though it is technically challenging.

Most controllers have at least five years of experience in an accounting-related field. They often start as cost accountants before moving up to the controller position. During this time, they should have acquired the necessary financial knowledge and leadership skills to successfully perform this role. Some people begin their career in the position of assistant controllers. Here they learn about the role and demonstrate their ability.

Strategic controllers

Controllers' roles in organizations are changing. They are now expected to apply analytical skills to a wider range of strategic issues. They are increasingly becoming business partners for operational managers. They must be able to deliver both financial and non-financial information in an integrated manner.

The ability to manage short-term goals and long-term concerns is essential for strategic controllers. They must also be able influence upper management to make a case for new initiatives.

Comptrollers

The key role of controller accounting in the management of a company's finances is critical. These professionals must be numerate, have a good sense of business and excellent communication skills. They also need to be able to educate non-financial employees and enforce company policies in a collaborative way.

Larger organizations have their controllers, while smaller companies may have their own controller. They are similar to their counterparts from the C-Suite and are responsible for setting-up the financial infrastructure of a company, interpreting financial information, and supervising the accounting team.

Financial controllers

A financial controller is necessary for complex accounting and compliance requirements. This is often required as a result of a growing business. These professionals have extensive financial accounting training and are able to communicate with external auditors to avoid fraud. These professionals should have several decades of experience. But, not every company is right for the financial controller role.

Financial controllers are responsible to manage all aspects of financial planning for a company, including the evaluation of all insurance policies and financing. Executive management requires them to provide accurate financial information. In addition, they are responsible for coordinating all financial planning functions with business operations. The financial controller is responsible for creating financial statements and balance sheets, cash flows reports, as well as budgets.

FAQ

What should I do when hiring an accountant?

Ask about their qualifications, experience, and references when interviewing an accountant.

You want someone who has done this before and knows what he/she is doing.

Ask them if you could benefit from their special skills and knowledge.

Be sure to establish a good reputation within the community.

What does an accountant do, and why is it so important?

An accountant keeps track all the money that you earn and spend. They also record how much tax you pay and what deductions are allowable.

Accounting helps you manage your finances by keeping track your income and expenses.

They prepare financial reports for individuals and businesses.

Accountants are needed because they have to know everything about the numbers.

Accounting also assists people in filing taxes and ensuring that they pay as little as possible tax.

What is the difference between a CPA and a Chartered Accountant?

A chartered accountant is a professional accountant who has passed the exams required to obtain the designation. Chartered accountants have more experience than CPAs.

Chartered accountants also have the ability to provide tax advice.

The course of chartered accountantancy takes approximately 6 years.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

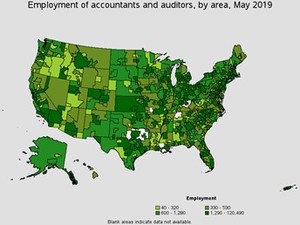

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

External Links

How To

How to do your bookkeeping

There are many kinds of accounting software. While some software is free and some cost money to purchase, many offer basic functions such as billing, invoicing, inventory management, payroll, point-of sale, financial reporting, and processing of payroll. Here is a list of the most commonly used accounting packages.

Free Accounting Software - This free software is often offered to personal use. It may have limited functionality (for example, you cannot create your own reports), but it is often very easy to learn how to use. A lot of free programs can be used to download data directly to spreadsheets. This makes them very useful for anyone who wants to do their own analysis.

Paid Accounting Software is for businesses with multiple employees. These accounts offer powerful tools for managing employee records as well as tracking sales and expense, creating reports, and automating processes. Many companies offer subscriptions with a shorter duration than six months, but most paid programs require a minimum subscription of at least one year.

Cloud Accounting Software: With cloud accounting software, you can access your files online from any device using smartphones or tablets. This type of program has become increasingly popular because it saves you space on your computer hard drive, reduces clutter, and makes working remotely much easier. It doesn't require you to install additional software. All that is required to access cloud storage services is an Internet connection.

Desktop Accounting Software: Desktop software works in a similar way to cloud accounting software. However, it runs locally on your own computer. Desktop software can be accessed from any device, including mobile devices, and works similarly to cloud software. However, unlike cloud, you have to install it on your computer before using it.

Mobile Accounting Software: This mobile accounting software was specifically developed to work on tablets and smartphones. These programs enable you to manage your finances even while you're on the move. Typically, they provide fewer functions than full-fledged desktop programs, but they're still valuable for people who spend a lot of time traveling or running errands.

Online Accounting Software - Online accounting software was created primarily to serve small businesses. It contains all the functions of a traditional desktop application, as well as some additional features. Online software has one advantage: it doesn't require installation. Simply log on to the site and begin using the program. Online software also offers the opportunity to save money as you can avoid local office fees.